Warren Buffett acknowledged his late partner, Charlie Munger, as the mastermind behind the Berkshire Hathaway conglomerate that he’s credited with leading.

In his annual letter to shareholders, he cautioned against heeding the advice of Wall Street pundits or financial advisors who encourage frequent trading.

Warren Buffett shared the success of Berkshire’s insurance ventures:

Buffett shared the success of Berkshire’s insurance ventures in the past year while expressing disappointment in the performance of its extensive utilities and BNSF railroad. He reassured shareholders of his long-term commitment by stating his intention to retain stakes in approximately 30% of Occidental Petroleum and 9.0% of five major Japanese trading houses. However, he said that there are no plans to acquire the oil producer outright.

During the final quarter, Berkshire’s diverse portfolio of companies and robust investment returns generated a staggering profit of $37.57 billion, equaling $26,043 per Class A share. Compared to the previous year’s earnings of $18.08 billion, or $12,355 per Class A share, this marks a significant increase of over twofold.

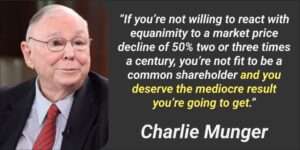

Charlie Munger’s advice to investors:

Warren Buffett’s advice to investors:

However, Buffett advised caution when interpreting the overall profits due to their substantial dependence upon the fluctuating valuation of Berkshire’s investments. To gain an obvious perspective, he motivated to analyze the company’s operational earnings, which do not incorporate investment gains.

As per, Berkshire’s operational earnings data, there was a 28% rise to $8.48 billion, equal to $5,878.21 per Class A share. This exceeded the previous quarter’s earnings of $6.63 billion, or $4,527.06 per Class A share. Three analysts by FactSet Research had projected quarterly operating earnings of $5,717.17 per Class A share.

Just some time back, Berkshire Hathaway’s stock made a new record and touched a peak of $632,820 per Class A share amidst investor anticipation of Warren Buffett’s annual letter. Buffett continues to take attention from the audiences worldwide. His annual report is always on top amongst the most popular documents in the business. community.