Table of Contents

If you are also thinking of borrowing money to pay college and school fees, you are not the only person doing so. College Board has stated in one of its reports that 54% of bachelor’s degree recipients of public or private universities are suffering from student loan debt.

Two main loan types are more popular right now, federal loans and private loans. Now it depends on you which loan you take and you should choose it wisely as it can impact your repayment options and overall cost.

Is a federal or private loan better? The answer to this question depends on your financial condition and future goals.

What are federal student loans?

A federal loan is a loan that is funded by the federal government and it also has some advantages if we compare it to other types of loans, such as lower interest rates, and flexible repayment options, and the biggest advantage is forgiveness eligibility and program cancellation.

Student loan types or Student loan options

Here are four types of student loans available from the federal government to students and their parents:

Direct Subsidized:

This loan is for undergraduate students. For this, students must have a valid significant financial need.

The government is forgiving loans for those students who earn loans during the grace period while they are in school.

Direct Unsubsidized:

Direct Unsubsidized loans can be used for graduate or post-graduate programs. Student loan rates used for graduate school will be higher. Whatever interest is earned, students are responsible for it.

Grad PLUS:

Graduate and post-graduate students can borrow up to the total cost of attendance for their programs through this Grad Plus Loan.

Parent PLUS:

Parents who have biological or adopted children can borrow money for their education through this Parent Plus Loan.

All federal loans have fixed interest rates, and all borrowers qualify for the same rate as this type of loan, regardless of credit or income. All federal student loans have repayment terms of 10 years. That’s why, It is considered as best student loan program.

What is a private student loan?

Only 7% of the overall student market is private loans. Private student loans can come from banks, credit unions, and other financial institutions.

We know that the federal provides fixed interest rates, and private student loans provide us with both fixed and variable loan rates.

Variable-rate loans have low initial interest rates, but these rates can change over time. Its repayment term ranges between 5 to 15 years.

Students can use the private student loans option to pay the fees for their undergraduate and postgraduate programs, but one thing to note is that these loans are credit-based and not everyone will qualify for it.

Before opting for these loans, You should go for student loan assistance, there are many third-party and reliable sources are there.

Private Loan Eligibility

Eligibility for a private loan depends on the lender. However, lenders usually check the borrower’s credit score – meaning your chances will increase if the FICO credit score is 670 or higher.

Since college students may not have a good credit score or there will be many students who do not have any credit history and may not have any source of income. In this case, students have to get a co-sign for the loan from their parents or relatives.

After signing the CO-sign, the relative also becomes responsible for the loan repayment if the primary borrower fails to repay the loan.

Here is the link, you can decide the right student loan for you.

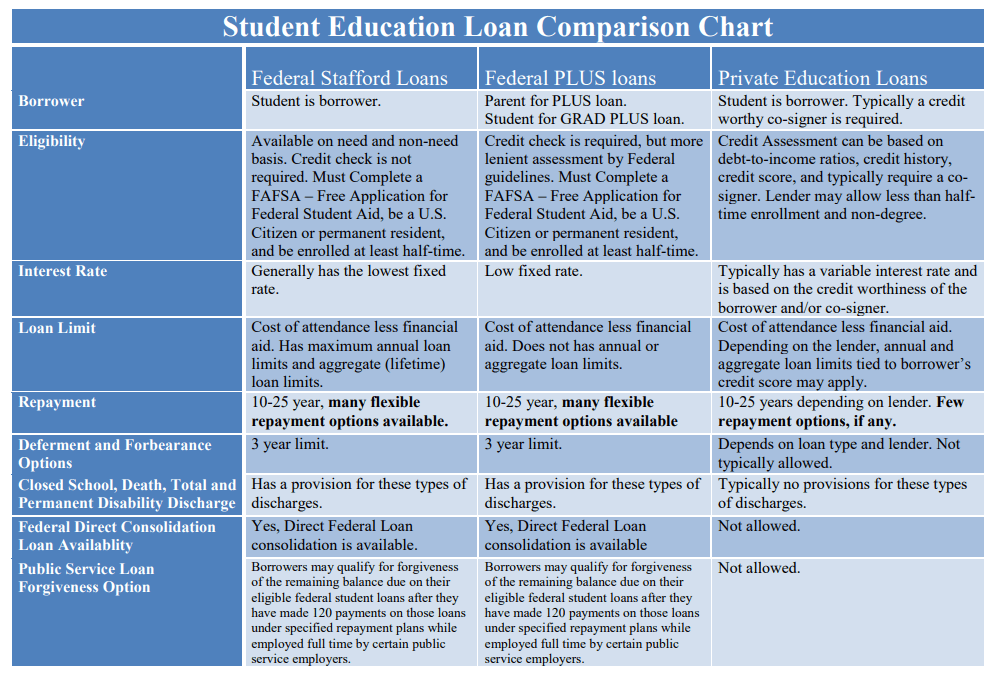

Federal Loans Comparison Chart

Loan Repayment option after graduation?

Although federal student loans always protect the borrower, depending on your situation, you may be eligible for the following options:

- If you are unemployed or sick:

If you become seriously ill or lose your job, you may be eligible for the federal disability program. Under this program, you can postpone or hold your payment for the next several months. - If your payment is high:

If you are not able to handle the monthly repayments well for the decided 10-year tenure then you may be eligible for Income-Driven Repayment (IDR). - Again returned to school:

If you are re-enrolling in school or college to pursue another degree, you may still be able to defer federal student loan payments until your new degree coursework is complete.

Loan Forgiveness eligibility and student loan cancellation:

Federal student loans are eligible for the loan forgiveness program.

For example:

Public Service Loan Forgiveness:

After fulfilling the program’s eligibility requirement, the borrower can get up to 100% of his outstanding loans forgiven. To be eligible for this, you will have to work full-time for at least 10 years in a non-profit organization and make monthly payments of Rs.120.

Income-Driven Repayment Discharge:

If you still have some outstanding payments till the end of your loan term and you have already signed up for the IDR program, the government will waive the remaining loan payment.

Teacher Loan Forgiveness:

If a teacher teaches a highly demanding subject in a school with low income for 5 years then his loan amount of $17500 can be waived off by the federal government.

By using the above three, you may be eligible for Student loan debt relief.

Read Next: Why is it important to know your Social Security in 2024?

Student Loan Calculator

These are some best calculators which provide you loans amount and repayment predictions based on your input.